Your business’ finances are likely to be complex. You have to consider things like the costs of doing business, your pricing strategies, and taxes. Without a clear idea of how your business runs financially, you can expect your returns to be inconsistent at best, and imaginary if you remain in the dark.

Cash flow statements make your accounting easier to understand by providing a simplified view of how cash has moved into and out of your business. They’re a useful tool for managing your expenditures and can inform you about how well your business is doing at a glance. They also play a key role in conducting cash flow analysis, where you take a closer look at your income and expenses to spot patterns and areas for optimisation.

This guide will equip you with everything you need to know about them. We’ll break down exactly what they are, show you how they are used in small business accounting, and finally show you how to create one yourself.

What are cash flow statements?

A cash flow statement is an organised summary of your business’ income and expenses (i.e. your cash flow). Unlike a balance sheet or income statement, cash flow statements don’t concern themselves with projected income, assets, or liabilities. They’re simply a record of how physical cash or cash equivalents such as cheques have moved into (cash inflows) and out of your business (cash outflows).

3 Sections of a Cash Flow Statement

First is the section containing cash flows that come from your operating activities. These are any and all cash flows that come from your main source of revenue generation such as the sales and purchases of goods and services. Examples of this would be the money you earn from clients, and the money you spend on a regular basis in order to get the job done.

The second section contains the cash flows from investing activities. An investing activity is anything done in order to generate future income. Examples of this would be the purchase of a necessary piece of equipment such as a new washing machine for a laundromat.

The third and final section is comprised of cash flows from financing activities. Financing activities are defined as transactions that are conducted between stockholders, creditors, etc. This is the section where you would list down the cash that you’ve spent out to pay off any persons or businesses whom you owe money, and cash coming in from loans and investors.

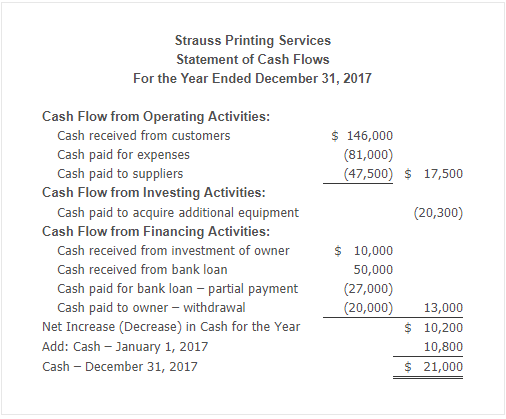

Below is an example of what a cash flow statement looks like:

The company made $206,000, spent $195,000, and was left with $21,000 after factoring in their initial cash reserves ($10,800).

As you can see, the structure for each section of the statement begins with an indication of cash received followed by cash paid encased in parentheses. The net cash flow per section is also written at the bottom right, and a line is written underneath the final item of the section to indicate that a computation has been made.

The net cash flow for the period is denoted at the end followed by the starting balance from the beginning of the period. These are summed up at the very bottom to indicate the total cash flow for the time period and placed above two lines to indicate the end of the statement.

The final thing to note is that the above cash flow statement covers an entire year. We recommend that you make these regularly (monthly is best) and not just at the end of the year. Keeping track this way helps you gather data for later trend-spotting, and forces you into the habit of minding your liquidity.

How do I use a cash flow statement?

Cash flow statements can be used in a variety of ways to make small business accounting easier for tradies.

4 Steps on How to Use a Cash Flow Statement

- Preparation

- Prediction

- Optimisation

- Expansion

1. Preparation

Every small business goes through its fair share of rough patches. Accidents happen, equipment breaks down, natural calamities strike –and it’s best to be prepared for these unplanned expenses. After all, few things are worse than going through a sudden business catastrophe without the funds to bail yourself out.

A well-crafted cash flow statement can help you with this by letting you know exactly how liquid you are. If you find yourself in a particularly nasty bind, it’s imperative to be prepared with the right amount of cash on hand so that you can take the necessary steps to deal with it.

2. Prediction

Cash flow statements can also help you make predictions about your future spending via cash flow projections. Because the statements are made for specific periods of time, you can compile your data in order to identify trends in both spending and earning, and therefore estimate how much money you’re likely to spend and earn in the following time period. These statistics can prove very useful for small businesses, especially those that are looking to grow their business.

3. Optimisation

If there’s one thing that every business tries to do, it’s reduce cost –after all, cost reduction is one of the sure-fire ways to increase your income and expand your business. Cash flow statements make this much easier by showing you exactly where you’re spending most of your money.

Is a big chunk of your cash going into the maintenance and repair of equipment? Maybe it’s time to buy new gear. Is a significant percent of your income being spent on utilities? Maybe it’s time to implement stricter policies regarding the use of water and electricity.

In any case, having a good cash flow statement makes it much easier to spot these costs and make the necessary adjustments to mitigate them.

4. Expansion

Finally, well-constructed cash flow statements are a necessity when dealing with investors. It’ll be so much easier to claim that your business is on the up and up when you have the appropriate documents to prove it. Your cash flow statements can give potential investors a good idea of how fast your business is growing and how profitable it could be for them to invest in. They can also be a reflection of how well you manage your finances and expenditures which any investor would want to know before they set anything in stone.

How do I make a cash flow statement?

The first, and perhaps smartest move you can make when trying to create a cash flow statement is to ask your accountant to take the lead. It is after all what you’re paying to do, and they should know the ins and outs of the process better than anyone else under your employ.

If you’re interested in making them on your own, however, you can follow these three simple steps:

3 Steps on How to Make a Cash Flow Statement

- Find a template or outline that works for you. While most if not all cash flow statements contain the same information, the way it is presented can differ based on your specific needs and the complexity of your data.

- Collect the necessary data for the statement. These are likely to come from receipts, invoices, and other proofs of purchase that you should be keeping on file.

- Encode the data you’ve collected. Make sure to place them in the appropriate sections* of the statement.

It’s important to note that items under the “Investing Activity” section of a statement should only reflect transactions that happen within the time period that it covers. For example, if you acquired a truck in June but made payments through to December, the statement for June will not reflect anything related to the cost of the truck except perhaps any initial payments made.

There are also a lot of different small business accounting tools available for you to use when generating a cash flow statement by yourself. You can find these tools online and they’re usually worth investing in.

Conclusion

Remember that in the world of business numbers often speak the loudest. Given this, one of the best things that you can do is arm yourself with as many tools as you can to learn and understand what they have to say.

Hopefully this guide has given you enough insight and knowledge to not only keep your business alive but to make it thrive. The road to building and running a successful business may seem long and arduous, but cash flow statements are here to help you on your journey.